About Us

Mission

A “redevelopment agency” is an entity authorized by the State of Utah that implements the development goals of communities and is governed by state statute; There are more than 90 such agencies representing cities across Utah, with Salt Lake City’s being one of the oldest. For more than 50 years, the Redevelopment Agency of Salt Lake City (RDA) has been investing in redevelopment projects and programs that shape communities and provide gap financing to encourage and leverage private sector investment.

It is our mission to strengthen neighborhoods and business districts to improve livability, create economic opportunity, and foster authentic, equitable communities. We serve as a catalyst for strategic development projects that enhance the City’s housing opportunities, commercial vitality, public spaces, and environmental sustainability.

Values

Economic Opportunity

Equity and Inclusion

Neighborhood Vibrancy

Livability Benchmarks

Adhering to our mission and values, we are further inspired to provide public benefits within our projects through a set of Livability Benchmarks that align with our core values of Economic Opportunity, Equity & Inclusion, and Neighborhood Vibrancy.

We use the following benchmarks to evaluate and prioritize projects requesting RDA participation:

Economic Opportunity Benchmarks

Leveraging | To promote the leveraging of non-RDA/City sources of funding and maximize private investment.

Timeliness | To support projects that have a reasonable timeframe for completion.

Return on Investment | To promote the return on RDA resources, thereby enabling resources to extend further into the community.

Permanent Job Creation | To promote balanced neighborhood economies that produce quality jobs.

Affordable Commercial Spaces | To decrease the displacement risk of existing community businesses and reduce the barriers of entry for new, underrepresented business and service types, particularly locally-owned and independent businesses and non-profits that promote neighborhood identity, economic vitality, and local economic multipliers.

Ownership | To encourage the creation of opportunities for residents/business owners to build wealth and establish permanent roots through affordable home/commercial ownership.

Equity & Inclusion Benchmarks

Transportation Opportunities | To promote a multimodal transportation network that ensures convenient and equitable access to a variety of transportation options.

Mixed-income neighborhoods: To promote mixed-income developments, economically integrated communities, and housing opportunities for low-income residents.

Neighborhood Safety | To reduce the number of vacant and distressed buildings and lots, decrease crime, and return the land to productive use.

Community Engagement + Support | To provide a more robust platform that enables community members to inform and influence development projects during initial planning stages and preserve cultural heritage.

Housing for Everyone | To promote housing for families and underserved populations.

Displacement Mitigation | To mitigate the displacement of current residents and residents with generational ties to the neighborhood while providing opportunities for those who have already been displaced to return.

Affordable Housing Preservation | To preserve existing affordable housing.

Neighborhood Vibrancy Benchmarks

Public Space | To promote community amenities that provide opportunities for social interaction; support cultural events; promote neighborhood identity; and reinforce neighborhood character.

Public Art | To promote cultural expression that adds to the experience and value of the built environment through art that is publicly visible and accessible for all to experience.

Architecture + Urban Design | To promote high-quality architecture that enhances the public realm strengthens the neighborhood’s unique character and uses enduring materials.

Sustainability | To promote a built environment that protects resources and promotes greater resiliency.

Walkability | To promote walkable neighborhoods and connectivity that supports a safe and engaging pedestrian experience.

Building Preservation, Rehabilitation, or Adaptive Reuse | To acknowledge a neighborhood’s history and maintain its unique character through preservation, rehabilitation, or repurposing of historic or underutilized structures.

Missing Middle + Unique Housing Types: To promote an array of project types that diversify the City’s housing stock/forms and provide more affordable living options for residents.

More about our projects and policies can be found on the “What We Do” page.

Governance

The Board of Directors (Board) is comprised of the seven members of the City Council of Salt Lake City and has policy-making authority, while the Mayor serves as the Executive Director and has administrative power. The Redevelopment Advisory Committee (RAC) advises the Board on RDA policy and the Finance Committee provides recommendations on loan applications, tax increment reimbursement agreements, and land write-downs.

Administration

Board of Directors

Alejandro Puy, Chair

Darin Mano, VIce Chair

Dan Dugan, Director

Victoria Petro, Director

Eva Lopez Chavez, Director

Chris Wharton, Director

Sarah Young, Director

Redevelopment Advisory Committee

Mojdeh Sakaki, Chair

Brian Doughty, Vice Chair

Rosa Bandeirinha

Jason Head

Mark Isaac

Nicholas Peterson

Baxter Reecer

Amy Rowland

Finance Committee

Danny Walz, SLC Redevelopment Agency

Blake Thomas, SLC Community and Neighborhoods

Peter Makowski, SLC Department of Economic Development

Tony Milner, SLC Housing Stability

Mary Beth Thompson, SLC Finance

Amy Rowland, RAC Member

Baxter Reecer, RAC Member

Funding

Redevelopment agencies are authorized by the State to direct funding to specific parts of a municipality through “project areas,” which are established through a multi-step, public process and guided by project area plans. The project area plans outline housing developments, infrastructure improvements, and/or economic development efforts, as well as a budget that typically spans 20+ years.

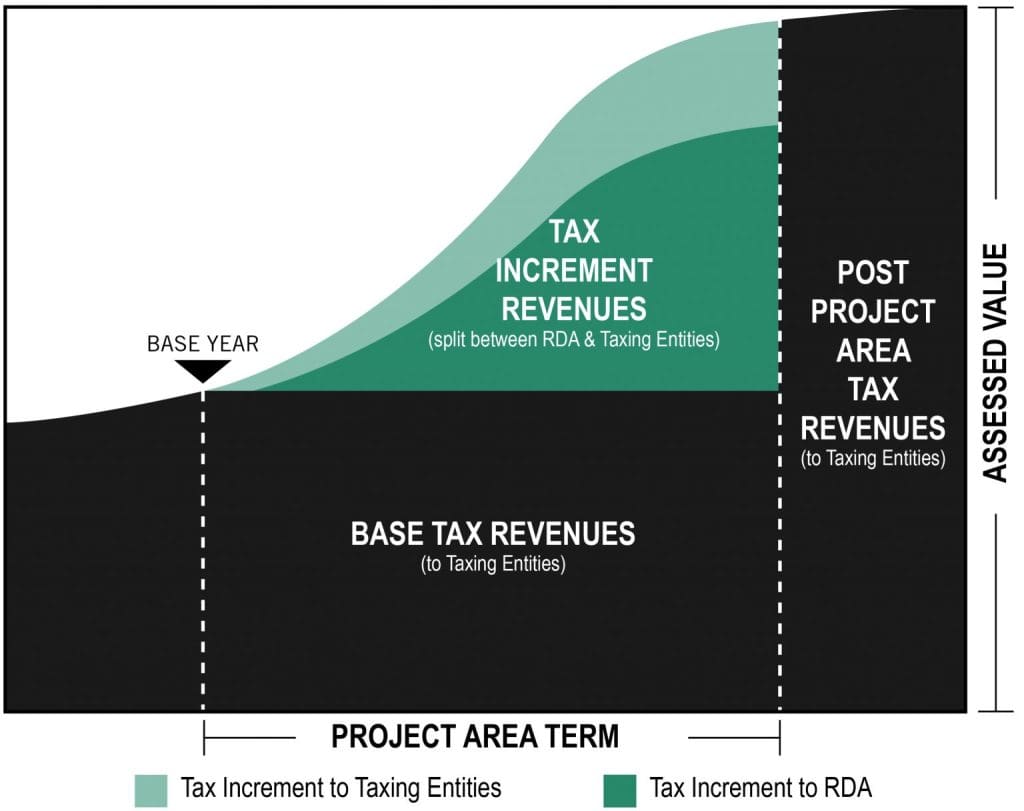

We primarily fund redevelopment projects within these project areas with property tax increment – also called “tax increment”. Tax increment is the increase in the property taxes generated within an RDA project area over and above the property taxes generated in that same area prior to the establishment of the project area. We use tax increment financing (“TIF”) within project areas to fund projects and programs that improve livability, create economic opportunity, and foster authentic and equitable communities.

We partner with the taxing entities Salt Lake City, Salt Lake County, and Salt Lake City School District to capture a portion of their tax increment to fund activities that implement shared goals within the project area plan. The establishment of a project area and the collection of tax increment funds must be approved by the RDA Board of Directors and the local taxing entities.

The tax increment generated in a project area is reinvested into that same project area, thus recycling the funds for a specified period of time, usually 20-25 years, and contributes to the area’s overall economic health and vitality. After the given amount of time, the tax increment will again be available to the local taxing entities. During the life of the project area, the taxing entities continue to receive the same amount of property taxes that they received prior to the establishment of the project area, along with any share of the increment they may have negotiated with the RDA.

Our investment in strategic project areas spur private and additional public investment which, in turn, makes way for social, economic, and productivity growth within those areas.

Staff

Audit

Understanding the Audit

The RDA is required by Utah Code Section 17C-1-604 to conduct, approve, and publish an independent audit of its financial condition. The primary purpose of this audit is to report the amount of tax increment collected by the RDA for each project area; the amount of tax increment paid to each taxing entity; the outstanding principal amount of bonds or loans; the amount expended for acquisition of property, site improvements, public utilities, or other public improvements; and the RDA’s administrative costs. While the last few pages of the audit provide some information on a project area basis, the majority of the audit combines revenues and expenses from all RDA activities.

While the audit serves these functions well, the final report does not reflect many of the nuances of the RDA’s finances. In the past, this has caused confusion among those reading the audit without a full understanding of other RDA-related obligations and requirements.

In particular, the audit’s reference to “unrestricted cash,” without explanation, can be misleading. The term “unrestricted,” while having a very specific meaning in accounting parlance, carries an unfortunate implication that the funds are completely available for any purpose, which is not the case.

There are three primary limitations on the use of “unrestricted cash” by the RDA:

1. Payment Of Debt Service And Tax Increment Reimbursements Through Previous Agreements

Some of the funds included in the total dollar figure represented as “unrestricted cash” are already committed through various contracts and agreements the RDA has executed. For example, the RDA periodically enters tax-increment reimbursement agreements with private developers, whereby a portion of the increased property taxes associated with a particular development will be refunded to that developer, in exchange for the developer’s provision of some public benefit, such as structured public parking, restoration of an historic building, or creation of public spaces or plazas. The funds for payment of this obligation must be budgeted each year, and, until the payment is made, those funds remain in our accounts as “unrestricted cash.” Technically, the RDA Board could elect to spend those funds for some other purpose, but doing so would entail defaulting on the RDA’s agreement with that developer. Likewise, the RDA sometimes enters Interlocal Agreements with other agencies, such as Salt Lake City, that obligate it to make ongoing payments totaling a certain amount. The funds for those payments remain as “unrestricted cash” until the payment is made.

2. Project Area Restrictions

The annual audit treats all of the RDA’s funds as a single account. But state law requires that funds generated in an RDA project area be spent within the boundaries of that area, subject to a few narrow exceptions. Therefore, while the total pooled cash of the RDA is characterized by the audit as “unrestricted,” it is, in fact, available only to be spent in the project area where it was generated. The RDA carefully tracks the funds collected by the project area of origin, and treats each project area as a separate and distinct account, ensuring that funds generated from a particular area are expended only within that area. While the RDA’s budget process described above clearly allocates expenditures by project area, the annual audit does not make this distinction, sometimes creating the inaccurate impression that the full cash balances of the RDA could be spent on a single project in a single project area.

3. Allocations Over Time — Savings-Based Approach

Another detail that is not articulated in the annual audit is the RDA’s practice of budgeting funds for large projects over time, and then paying cash for the projects when sufficient funds are accumulated to proceed. This savings-based, or cash-based approach is very conservative, and enables the RDA to tackle large infrastructure projects without having to assume debt. Because tax increment proceeds are often viewed by banks as unpredictable, borrowing against future revenues is often not possible, and, even if possible, loans are not offered on favorable terms. Therefore, the RDA’s established practice and policy is to allocate funds as available a little at a time.

This process of accumulating funds for a project often leads to large cash balances in RDA accounts. A good example is the repair and renovation of the Gallivan Utah Center. Beginning in the early 2000s, the RDA anticipated that in approximately 2008-2010, the RDA would need to undertake significant repairs and renovations to the Gallivan Utah Center. Beginning in 2006, the RDA Board allocated funds each year to be saved for that renovation project, ultimately accumulating the more than $7 million needed to complete the design and construction. Those funds were always characterized by the audit as “unrestricted cash.” Again, the saved amounts could technically be allocated by the Board for some other use, but doing so would reduce or eliminate the funds needed for the renovation and repair project.

Privacy Policy

This website is maintained by the Redevelopment Agency of Salt Lake City and adheres to the Salt Lake City Privacy Policy.

This website does not collect or retain any personally identifiable information other than information voluntarily submitted by the user, such as when subscribing to our mailing list, or submitting contact information as part of a program application.

We secure any data provided to us. If you would like to access or correct anything you have submitted, you can do so by contacting rda@slc.gov.

Any website- or privacy-related questions should be emailed to rda@slcgov.com.